|

Blog Feeds

Public InquiryInterested in maladministration. Estd. 2005

Human Rights in IrelandIndymedia Ireland is a volunteer-run non-commercial open publishing website for local and international news, opinion & analysis, press releases and events. Its main objective is to enable the public to participate in reporting and analysis of the news and other important events and aspects of our daily lives and thereby give a voice to people.

Lockdown Skeptics

Voltaire NetworkVoltaire, international edition

|

Morgan Kelly predicts further fall in house prices as wave of mortgage defaults are next national |

miscellaneous |

other press national |

miscellaneous |

other press

Tuesday November 09, 2010 13:30 Tuesday November 09, 2010 13:30 by T by T

ECB keeping Ireland solvent for now In the latest piece in Monday's Irish Times from Prof. Morgan Kelly who at the height of the boom in 2007 said Anglo had lent over €100 billion and would eventually go bust, now says the country is facing a wave of mortgage defaults and that the country is effectively gone bust already. Morgan Kelly who flagged up our bubble economy long ago and got bad press for it, has struck again this week with an article in Monday's Irish Times, saying the country is basically bust already and is being quitely kept going for the moment by the European Central Bank (ECB) who are now the main source of funding for our banks.  by fachtna by fachtna Tue Nov 09, 2010 23:28 Tue Nov 09, 2010 23:28   While acknowledging that kelly predicted the banking crisis he has been less than reliable when it comes to the figures he uses to illustrate his conclusions. In his article he claims that 100K mortgages are in arrears. The current figure is in fact in the mid 30Ks. The latest figure, out on Friday next, will show a slight rise. Past behaviour suggests that most Irish people will keep servicing their mortgage - whatever the pain. Even in the US, where non-recourse mortgages are the norm, defaults have not reached anything approaching the rates Kelly predicts for Ireland where mortgagors can't just hand back the keys and walk away.  by FinancialTerrorists by FinancialTerrorists Wed Nov 10, 2010 09:17 Wed Nov 10, 2010 09:17   Morgan has done a good analysis. His story in the times  by W. Finnerty by W. Finnerty Wed Nov 10, 2010 14:26 Wed Nov 10, 2010 14:26   I would be very careful about any analysis of the present global financial and banking crisis which fails to make any mention at all of the crucially important roles that have to date been played by the privately owned Bank of England, and the privately owned US Federal Reserve system of banks.  by me by me Wed Nov 10, 2010 18:57 Wed Nov 10, 2010 18:57   Stop thinking of it as a take-over of your State and start thinking of it as a hostile take-over of your Company, Ireland Corp. ‘The gov’t is taking the best advice on this. We are being advised by N.M. Rothschilds . . . So, me saying ‘Rothschilds is managing NAMA’ was not quite correct. Still, hopefully you can understand my reasons for hearing even MORE alarm-bells concerning the whole NAMA farce, once I’d heard that little gem of conspiracy-fodder All economic booms and all economic recessions are mainly a result of an increase or a decrease in the available money supply. Since Central Banks regulate the money supply, it is obviously they who deliberately create the conditions for a boom or a recession. I have come to the conclusion that the recent Wall Street Banksters-bailout was a good example of recession-creation in action. Money that could have been circulated through the US economy providing health care or even maintaining infrastructure is hoovered out of the economy and disbursed amongst various banks who then refuse to re-lend the money as credit, thus halting the flow of credit the modern-day economy has been engineered to depend upon. Halting the credit flow decreases the overall money supply, and at the same time the Fed is debasing the dollar through the hilariously mis-titled process economists call ‘Quantitive easing’. Ireland appears to be dong it’s own version of that by propping-up the soon-to-useless dollar with money they can ill-afford to spare on such a dangerous ‘investment’. At the same time, acting on ‘advice’ from none other than N.M. Rothschilds they are bailing out banks and property developers by putting, what appear to me to be, totally unrealistic valuations on now-useless property in what is an over-saturated property market. The idea that these properties will sell for anything like these values in 7 or 8 years seems to me to be a totally preposterous notion. So again we see money which could have been used to help keep credit flowing and thus help maintain a somewhat healthy/robust economy is being directed into the pockets of the banks. There have been many reports of the Irish banks’ unwillingness to re-circulate this money back through the Irish economy. Curiously not one Irish economist or media-outlet has drawn attention to these similarities. But then I have come to believe that Economists are required in order to lay down a smokescreen by providing, or usually merely repeating, seemingly complex explanations (which upon closer examination usually turn out to be complete & utter pseudo-intellectual horse-excrement) for events that are usually relatively simple to explain (provided you are well-enough informed) If the Rothschild Investment Bank(Irish Gov advisors) main business is the lending of funds to governments, then is in their best interests for the country to prosper or go bankrupt??? Obviously, it is the latter! But it’s not so much the continuance of debt which gives the bankers their power that I find troubling but rather "What will they do with that power once they get it?" – what social and economic changes they will insist the debtor nations instigate in order to ensure continued funding? it’s exactly the same scenario laid out by John Perkins in his book Confessions of an Economic Hit Man - http://www.informationclearinghouse.info/article8171.htm Eventually EVERYTHING will be privatised. Including the Police. If you can’t afford it there will be no one to protect you, not that Police actually do much protection as it is, but in the future we will only have those ‘rights’ which we can afford to pay for. In the future, unless we take steps to stop it now – EVERY facet of human existence, from the cradle to the grave will be fully controlled by the banking elite/Corporations

by Sceptic . - None Whatsoever by Sceptic . - None Whatsoever  Thu Nov 11, 2010 09:05 Thu Nov 11, 2010 09:05   With the greatest of respect , Fianna Failure were the great fellas when the last general election  by opus diablos - the regressive hypocrite party by opus diablos - the regressive hypocrite party Thu Nov 11, 2010 13:40 Thu Nov 11, 2010 13:40   ..with your assessment of the soldiers of density. Not impressed by Enda d Barrel though. Falling for different gobshite is no answer.  by V by V Sun Nov 14, 2010 09:34 Sun Nov 14, 2010 09:34   “In spite of the holy promises of people to banish war once and for all, in spite of the cry of millions ‘never again war’ in spite of all the hopes for a better future I have this to say: - ‘If the present monetary system based on interest and compound interest, remains in operation, I dare to predict today that it will take less than 25 years until we have a new and even worse war. I can foresee the coming development clearly. The present degree of technological advancement will quickly result in a record performance of industry. The build up of capital will be fast in spite of the enormous losses during the war, and through the oversupply [of money] the interest rate will be lowered [until money speculators refuse to lower their rates any further] Money will then be hoarded [causing predictable deflation], economic activities will diminish and increasing numbers of unemployed persons will roam the streets…within these discontented masses, wild, revolutionary ideas will arise and with it also the poisonous plant called ‘Super Nationalism’ will proliferate. No country will understand the other, and the end can only be war again.” |

printable version

printable version

Digg this

Digg this del.icio.us

del.icio.us Furl

Furl Reddit

Reddit Technorati

Technorati Facebook

Facebook Gab

Gab Twitter

Twitter

View Comments Titles Only

save preference

Comments (8 of 8)

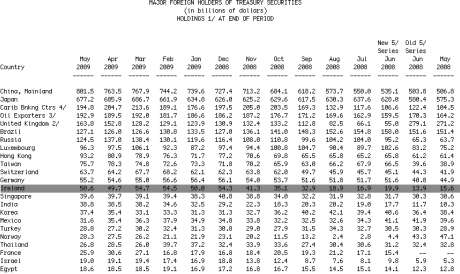

Jump To Comment: 1 2 3 4 5 6 7 8Here is a copy of the NAMA publication for the key data for Tranche 1 and 2 loans that have now been transferred onto the tax payers.

It is well worth downloading this document and browsing through the break down of the loans which is given by bank, sector and geographical region. You will find the actual facts don't exactly follow the story we have been given for the last 2 years which is that it is all just about housing. The attached image is a mosaic of two pages from the report showing how much of this debt we will have to pay is actually for loans made in the UK which shows this is not just some couple buying their first house (and get ripped off) but that we are in fact bailing out the wealthy buying commerical property abroad.

Geographical breakdown of tranche 1 & 2 loans to NAMA